Trump’s Impact on Stock Market Volatility

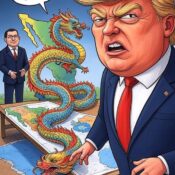

The U.S. stock market's current state is a tightrope walk, with volatility a constant companion. A significant driver of this instability is the recurring pattern of uncertainty injected by Trump's actions and pronouncements. Trade policies, in particular, remain a powder keg. Sudden tariff shifts or threats thereof send immediate shockwaves, disrupting carefully laid investment strategies.

This isn't merely about isolated market dips. It's the cumulative effect of unpredictability that erodes long-term confidence. Businesses, faced with a shifting landscape, hesitate on major investments, favoring short-term maneuvering over sustainable growth. This environment breeds a culture of speculation, a dangerous foundation for economic health.

The argument that this disruption is a necessary evil is increasingly flimsy. While momentary market upticks may follow certain announcements, they're often fleeting, overshadowed by subsequent turmoil. The net result is a market held hostage by uncertainty, undermining the very stability required for prosperity.

The reality is that the U.S. stock market, despite periods of apparent strength, is acutely vulnerable to the destabilizing influence of impulsive actions. This manufactured uncertainty offers no tangible long-term benefit, instead hindering the predictable economic climate essential for sustained growth. Investors and businesses are forced to operate in a state of perpetual anticipation, awaiting the next market-altering declaration.